|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

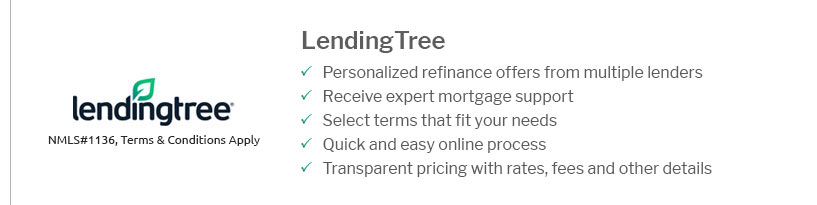

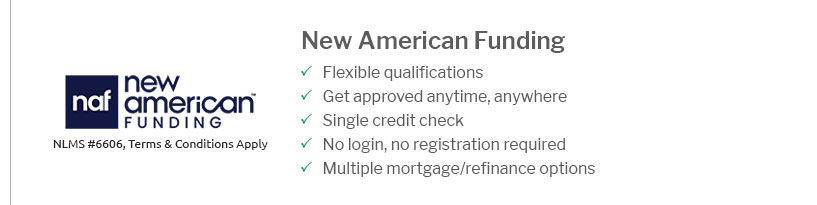

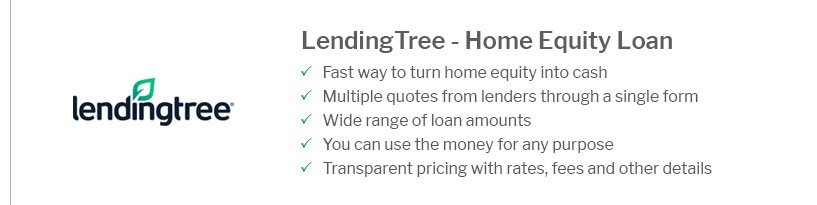

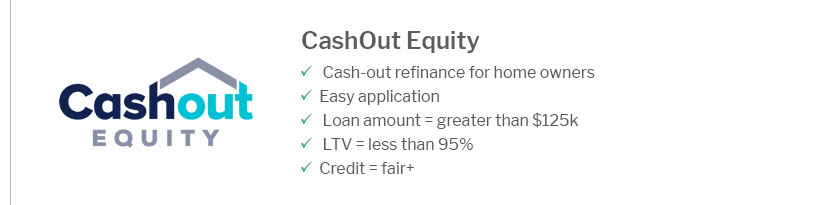

The Best Place to Refinance: Top Tips and ResourcesRefinancing your mortgage can be a strategic move to lower your monthly payments or take advantage of better interest rates. Finding the best place to refinance involves considering several factors, including rates, terms, and lender reputation. This article explores key aspects to guide you in making an informed decision. Understanding Refinancing OptionsFixed vs. Variable RatesWhen refinancing, you'll need to choose between a fixed or variable interest rate. Fixed rates provide stability with a consistent monthly payment, while variable rates may offer lower initial payments but can fluctuate over time. Loan TermsConsider the loan term length. A shorter term can save money on interest but will increase monthly payments. Conversely, a longer term reduces monthly payments but may result in paying more interest over time. Choosing the Right LenderIt's essential to compare offers from multiple lenders to find the best deal. Be sure to check reviews and ratings to ensure you're working with a reputable institution. For those interested in specific lender options, consider exploring manufactured mortgage lenders for specialized financial solutions. Online vs. Traditional LendersOnline lenders often provide quicker processes and competitive rates. However, traditional banks might offer personalized service and face-to-face interactions, which some borrowers prefer.

Steps to Successful Refinancing

To further aid your decision-making process, using a home mortgage interest rate comparison tool can be invaluable for finding the most competitive rates available. FAQWhat is the best time to refinance?The best time to refinance is when interest rates are significantly lower than your current rate, or when you need to adjust your loan terms to better suit your financial situation. How much can I save by refinancing?Savings depend on the difference in interest rates, your loan amount, and the length of the loan term. It's crucial to calculate your break-even point to determine if refinancing is beneficial. Are there any risks involved with refinancing?Potential risks include closing costs, the possibility of higher rates in the future, and extending the loan term which might lead to more interest paid over time. https://www.bankofamerica.com/auto-loans/auto-refinance-loan/

Apply online today to refinance your existing auto loan and you may be able to lower your monthly payments. https://www.reddit.com/r/Mortgages/comments/1fyzjit/current_options_for_refinance_rocket_loan_depot/

Go with a Mortgage Broker and not direct to lender. This is called the Wholesale channel & pricing is significantly better. NEXA, C2, Loan ... https://www.forbes.com/advisor/mortgages/refinance/best-mortgage-refinance-lenders/

Best for Closing Process. Flagstar Bank. Flagstar Bank ; Best Refinance Lender for a Seamless Application Process. SoFi. SoFi ; Best Refinance Lender for Medical ...

|

|---|